The financial services industry is undergoing a profound transformation. As institutions accelerate their shift toward digital-first business models, the limitations of legacy IT environments, particularly in credit management, are becoming increasingly untenable. Monolithic, inflexible systems are no longer capable of supporting the agility, scalability, and real-time responsiveness required in today’s competitive and highly regulated landscape.

Yet, despite the clear mandate for change, many organizations remain constrained. Nearly half of executives cite legacy systems as the primary barrier to executing digital strategies. Only 28% believe their operating models are sufficiently agile to support digital acceleration, and nearly 70% continue to struggle with recruiting and retaining the right IT talent. These challenges are compounded by mounting pressure to reduce costs while simultaneously investing in innovation.

Encouragingly, the appetite for transformation is growing. Two-thirds of enterprises plan to maintain or increase capital expenditure in the coming year, with more than half intending to invest more than $200 million in new IT programs over the next three years. Executive interest in managed services, application modernization, and cloud-native platforms is on the rise. Meanwhile, artificial intelligence, both traditional and generative, is gaining traction as a strategic lever for driving operational efficiency and innovation.

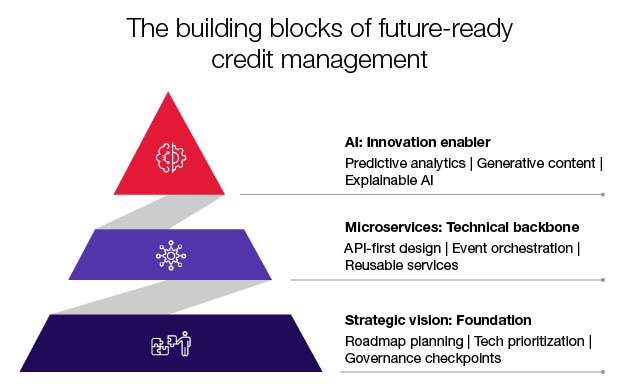

Modernizing credit infrastructure through a combination of cloud-native architecture, API-first microservices, event-driven orchestration, and AI offers a path forward. These technologies enable institutions to overcome legacy constraints and build a resilient, intelligent, and future-ready credit ecosystem. Here, we provide a roadmap based on our experience to help guide you down this path.

1. Define a strategic vision

- Start with a clear vision

-

Modernizing credit management begins with a clear destination. Without a well-defined vision, efforts can quickly devolve into a patchwork of disconnected components undermining both customer and employee experiences.

Your vision should include two key elements:

- Strategic business roadmap outlining what you aim to achieve

- Clear architectural blueprint to guide how you’ll get there

Avoid the temptation to apply a one-size-fits-all solution. Instead, evaluate each business need individually and choose the most appropriate technology for the job.

- Beware of “debt fatigue”

-

One common pitfall is debt fatigue—the exhaustion that sets in when modernization efforts are bogged down by outdated components, shifting integrations, and evolving regulations. This fatigue can derail progress.

To combat this:

- Design new components with upgradeability in mind, especially across microservices.

- Minimize your tech stack; only introduce new tools when absolutely necessary.

Encourage discipline among developers and architects. While it’s tempting to explore every new tool or framework, maintaining all of them can become unsustainable over time.

- Focus on integration and flexibility

-

Legacy systems aren’t going away overnight. Prioritize integration points and build flexible, swappable architecture in areas prone to frequent change. In some cases, leveraging third-party solutions that specialize in specific functions can accelerate progress and reduce complexity. In other cases, it may be beneficial to leave the function to be fulfilled by the existing legacy solution initially. Technology staff will consider it ideal when modernizing to immediately modernize everything, but a successful long-term roadmap involves prioritizing what and when to modernize.

- Modernization is a journey, not a straight line

-

Establish regular checkpoints to ensure your architecture remains aligned with your broader goals. These reviews should assess key decisions—like whether to use web sockets, event-driven messaging, or synchronous communication—and help you course correct as needed.

For example, while you successfully implement an event-driven architecture, you might fall short on maintaining a lean footprint. These checkpoints help you strike the right balance between innovation and sustainability.

2. Build a flexible foundation using microservices

Modern credit systems and microservices are essential for agility and growth. They can help overcome the limitations of legacy credit systems by driving efficiency, addressing security vulnerabilities, and simplifying operational complexity, enabling organizations to improve performance, accelerate innovation, and increase growth. To remain competitive in a rapidly evolving market, leading organizations are investing in next-generation, digitally-driven credit management solutions that deliver measurable improvements in agility, scalability, and the customer experience.

The technology landscape has shifted. Across industries, there’s a decisive move toward microservice-based architecture. For financial institutions, this means moving beyond monolithic legacy systems—often reliant on a single, centralized application—and embracing a modern, modular platform built on independent microservices.

- A balanced approach to microservices is essential

-

While moving to a microservice-based architecture offers significant benefits, adopting a strictly “purist” mindset—breaking every function into its own service—can create new challenges. We've seen this lead to microservice sprawl; an overly fragmented system becomes difficult to manage, undermining the very agility and scalability the architecture is meant to provide.

- Strategic service design is key

-

Success lies in thoughtfully mapping business domains and capabilities into services that group related functions while isolating those with high reuse potential. This process should be iterative:

- Overloaded services may need to be split.

- Highly coupled services may be better combined.

- Platform thinking helps avoid fragmentation

-

Look for common or repetitive capabilities across the application. These are strong candidates for platform services—reusable components that can be configured or lightly customized to deliver business functionality efficiently.

- The bottom line

-

A flexible architectural blueprint grounded in business needs, aligned with your strategic vision, and supported by the right patterns is critical for a successful and sustainable transition to microservices.

3. Embrace a practical AI approach

The next wave of innovation in credit management will be driven by artificial intelligence. However, to truly benefit from AI, organizations must move beyond the hype. This isn’t about throwing tools at problems; it’s about implementing AI strategically, ethically, and with purpose.

AI is not a passing trend. It’s here to stay, and its evolution is relentless. Organizations can’t afford to sit still. To keep pace, they need a flexible, adaptable AI strategy—one that evolves continuously and aligns with business goals.

At CGI, we advocate for a wide-eyed, practical, and human-centered approach to AI. This means integrating AI not as a buzzword, but as a core enabler of smarter decision-making, intelligent automation, and deeper insights. As part of your future-state vision, consider how AI can support:

- Predictive analytics to anticipate customer behavior

- Personalized interactions that improve engagement

- Automation that enhances efficiency without sacrificing control

- From templates to tailored experiences

-

Generative AI is opening new doors. Instead of relying on static templates or predefined policy options, organizations can now create personalized letters, offers, and policies tailored to individual customer needs. However, with this power comes risk.

Poorly managed generative AI can lead to inaccurate or inappropriate customer experiences, financially unsound decisions, or even regulatory violations. That’s why explainability is critical.

- The role of explainable AI (XAI)

-

Explainable AI (XAI) helps bridge the gap between complex models and human understanding. It enables organizations to:

- Provide customers with clear, actionable explanations

- Equip regulators with transparency into decision-making processes

- Investigate and audit AI-driven outcomes efficiently

By incorporating XAI, organizations can build trust, ensure fairness, and maintain compliance while still leveraging the full potential of AI.

- Using AI to build credit management systems

-

AI isn’t just transforming how credit is managed; it’s changing how credit systems are built. Developers can use AI to accelerate coding, testing, and service creation. Engineers can analyze and modernize legacy systems more efficiently. Testers can generate robust test cases using AI-driven insights. Architects and product managers can use AI to identify high-impact features, prioritize roadmaps, and uncover new opportunities for innovation. This isn’t just about building faster; it’s about building smarter.

Planning the journey ahead

Financial institutions that modernize legacy IT systems are uniquely positioned to unlock the transformative power of artificial intelligence and cloud-native architecture, streamlining operations, enhancing risk management, and delivering hyper-personalized customer experiences. AI is reshaping the financial landscape, from predictive analytics and fraud detection to intelligent automation and real-time decision-making. However, digital transformation is not a one-time initiative; it’s a continuous journey. To lead effectively, financial institutions must regularly reassess their technology strategies, remain agile, and adapt to emerging innovations that redefine customer expectations and competitive advantage.

As a long-standing partner to leading financial institutions worldwide, CGI understands the complexities of navigating constant change. For more than two decades, we’ve helped organizations across industries modernize and implement AI. We’ve also been on our own transformation journey, continually investing in our credit technology platform to support open, agile, and AI-ready systems. Our mission is to help clients become more competitive, innovative, and efficient, while managing risk and cost in alignment with their strategic goals.

For further discussion on credit management modernization, feel free to contact one of us (Laura or Michael).